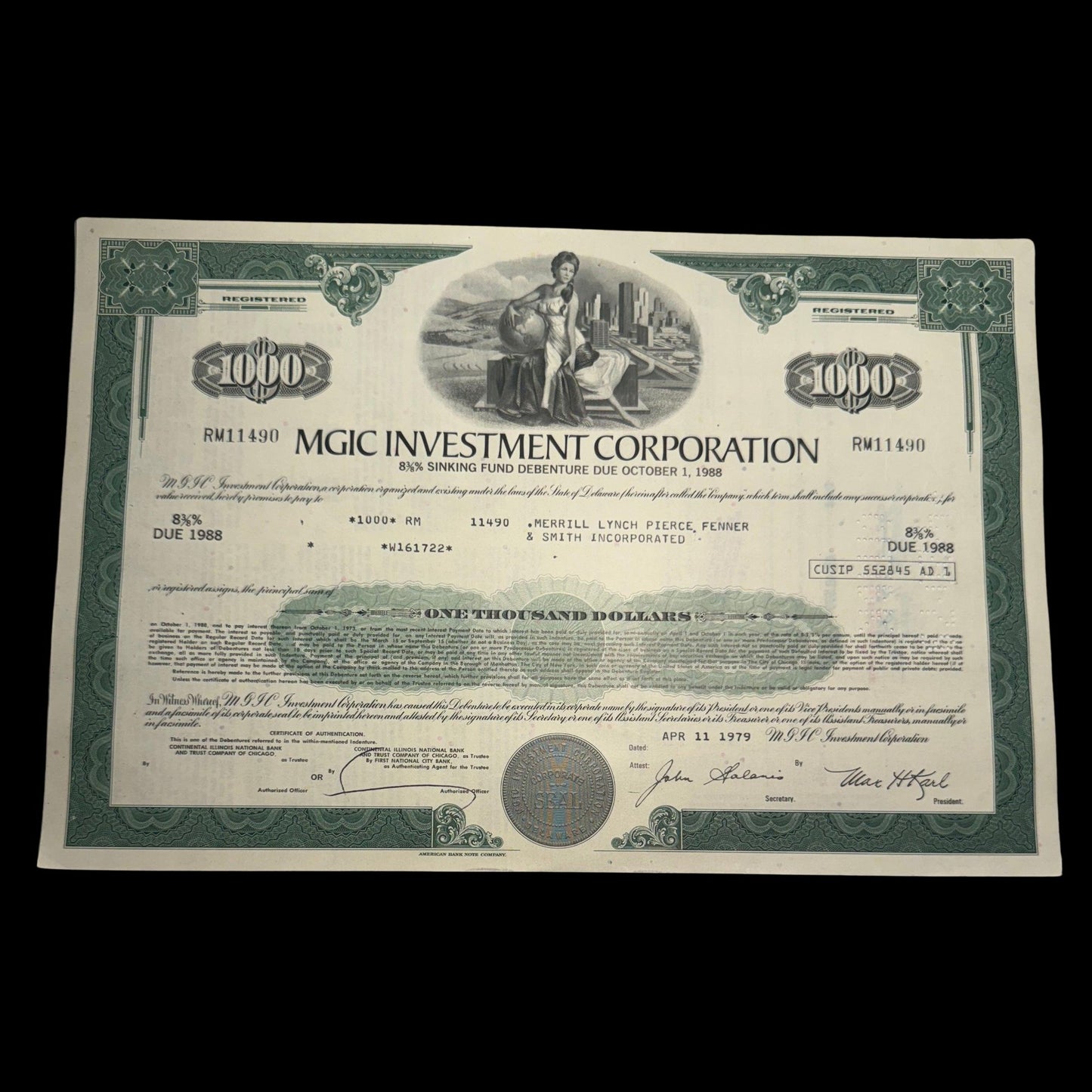

MGIC Investment Corporation Bond Certificate from 1970s

MGIC Investment Corporation Bond Certificate from 1970s

Couldn't load pickup availability

150+ 100% Positive Reviews! ⭐⭐⭐⭐⭐

Are the certificates authentic?

Are the certificates authentic?

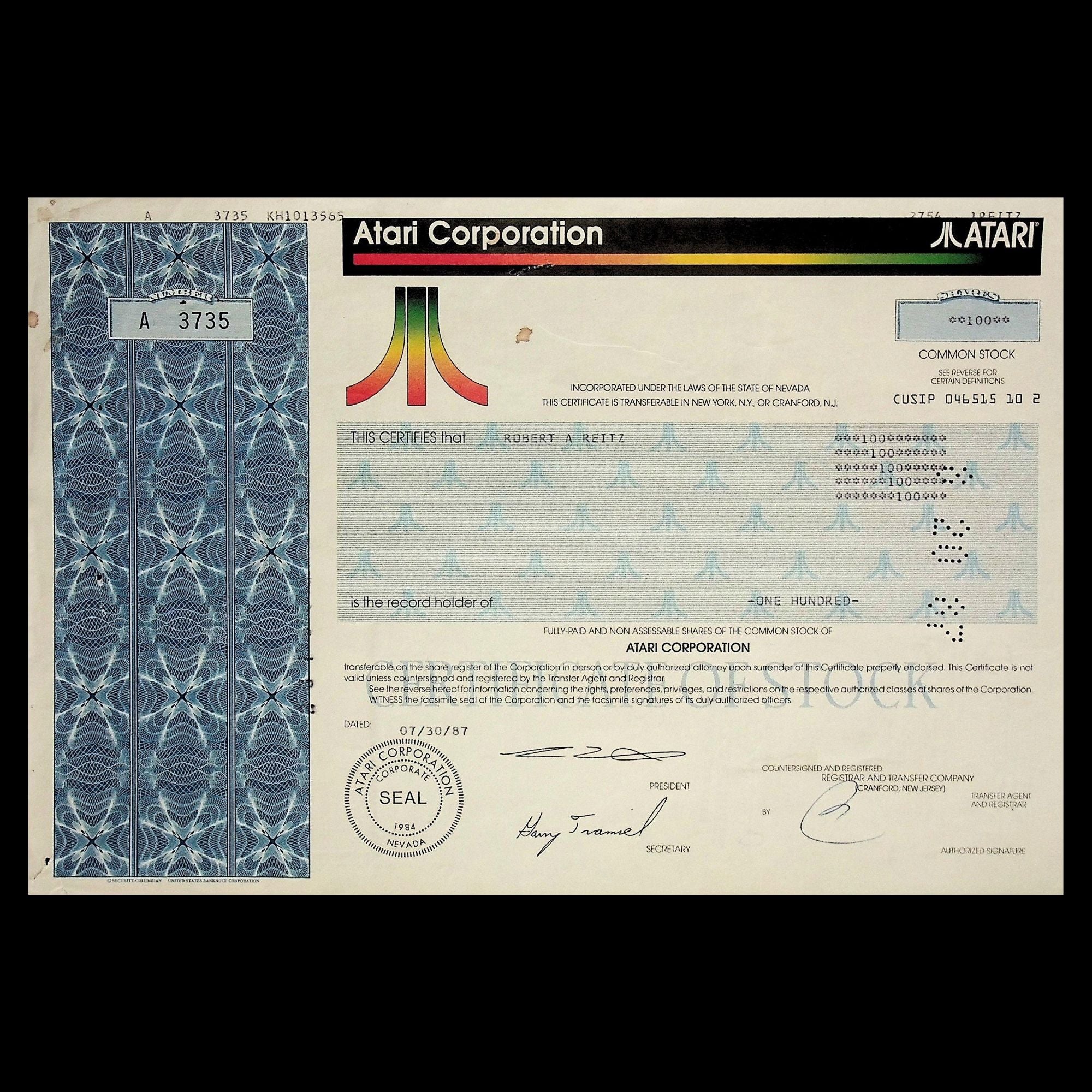

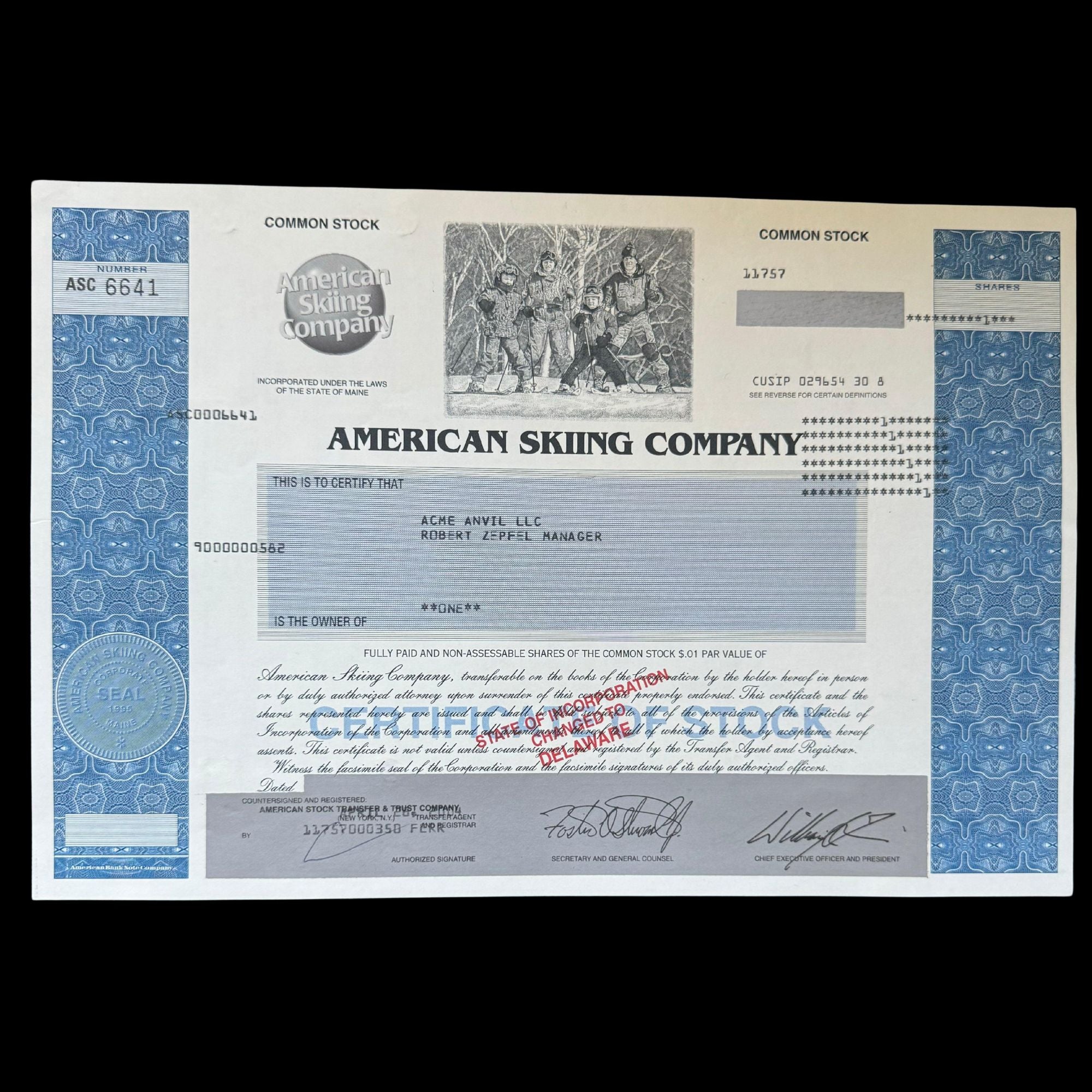

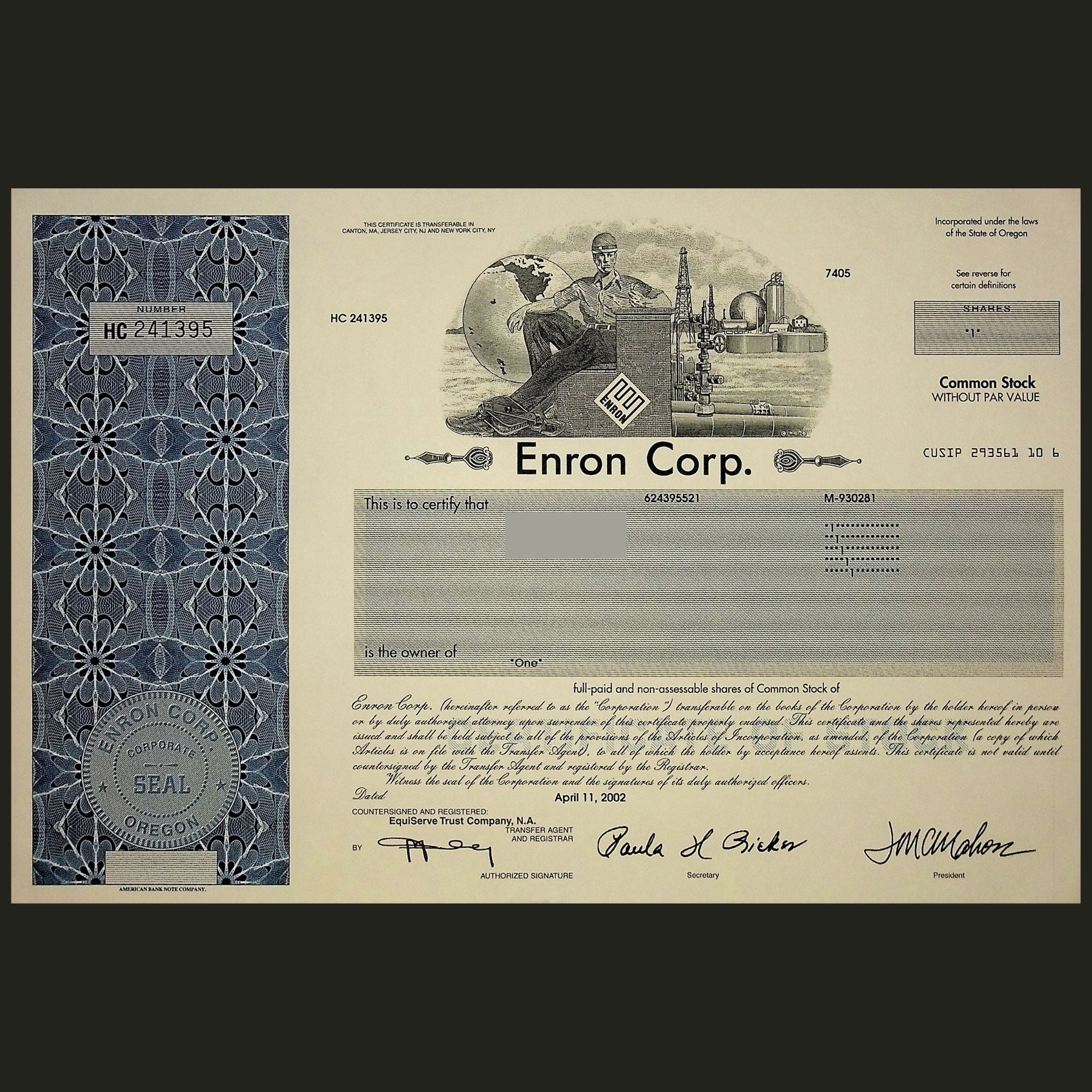

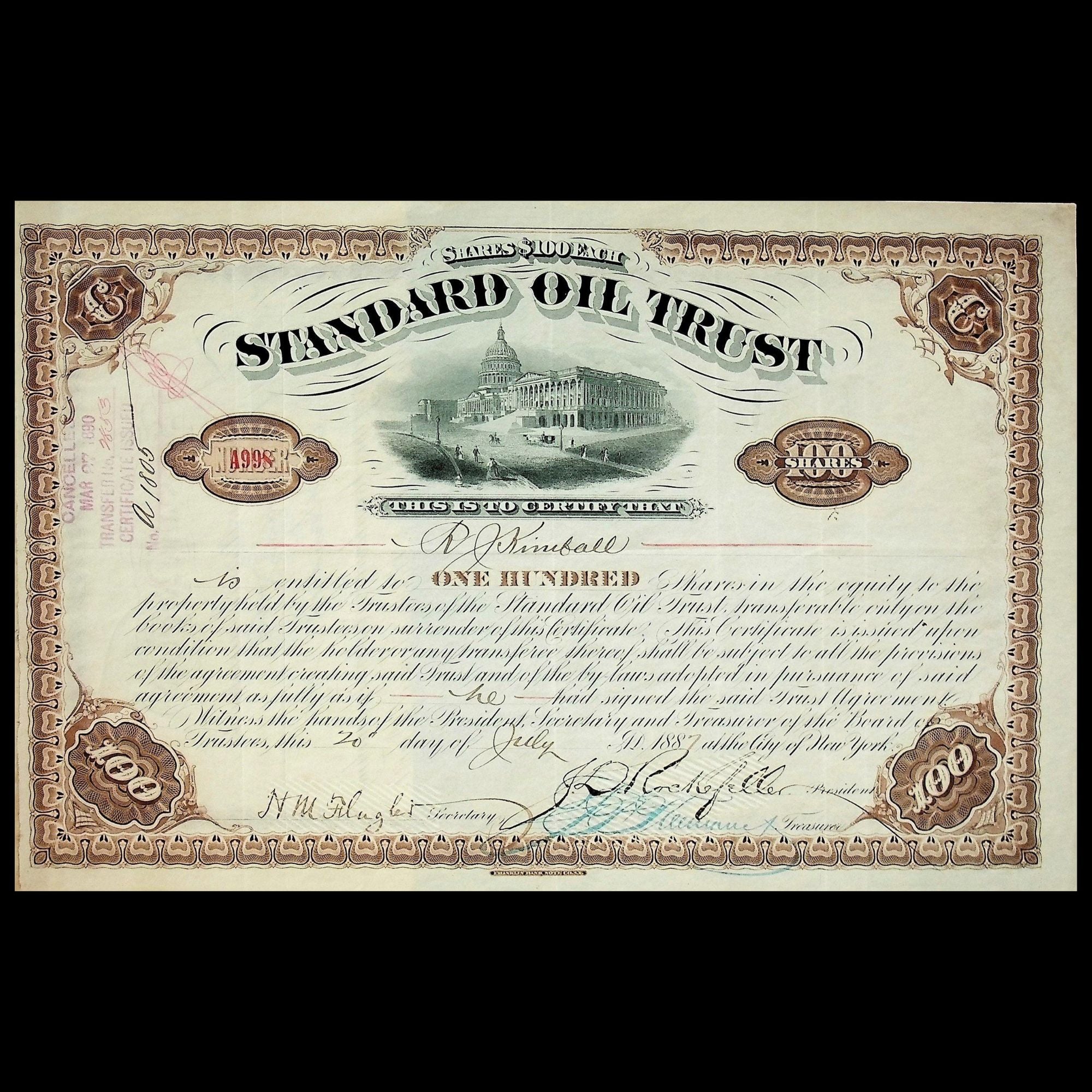

Yes, all of the certificates we sell are authentic stock and bond certificates unless otherwise mentioned in the description. At one point in time, this certificate represented a share of of the company, or a bond receipt. These certificates have been removed from circulation and digitalized, as seen by cancellation holes, stamps and writing on the certificate. We offer these certificates as a collectable item, not a security.

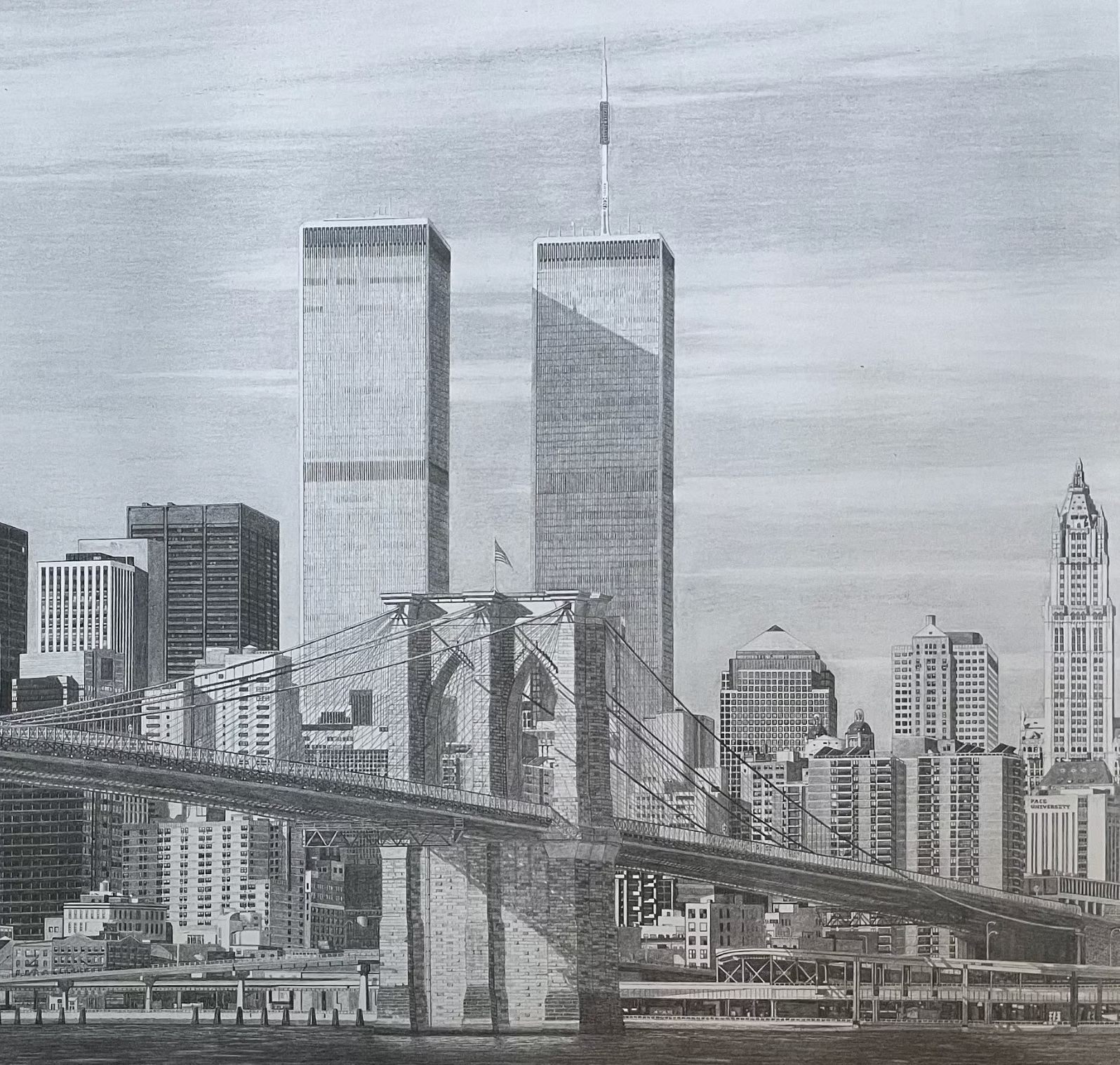

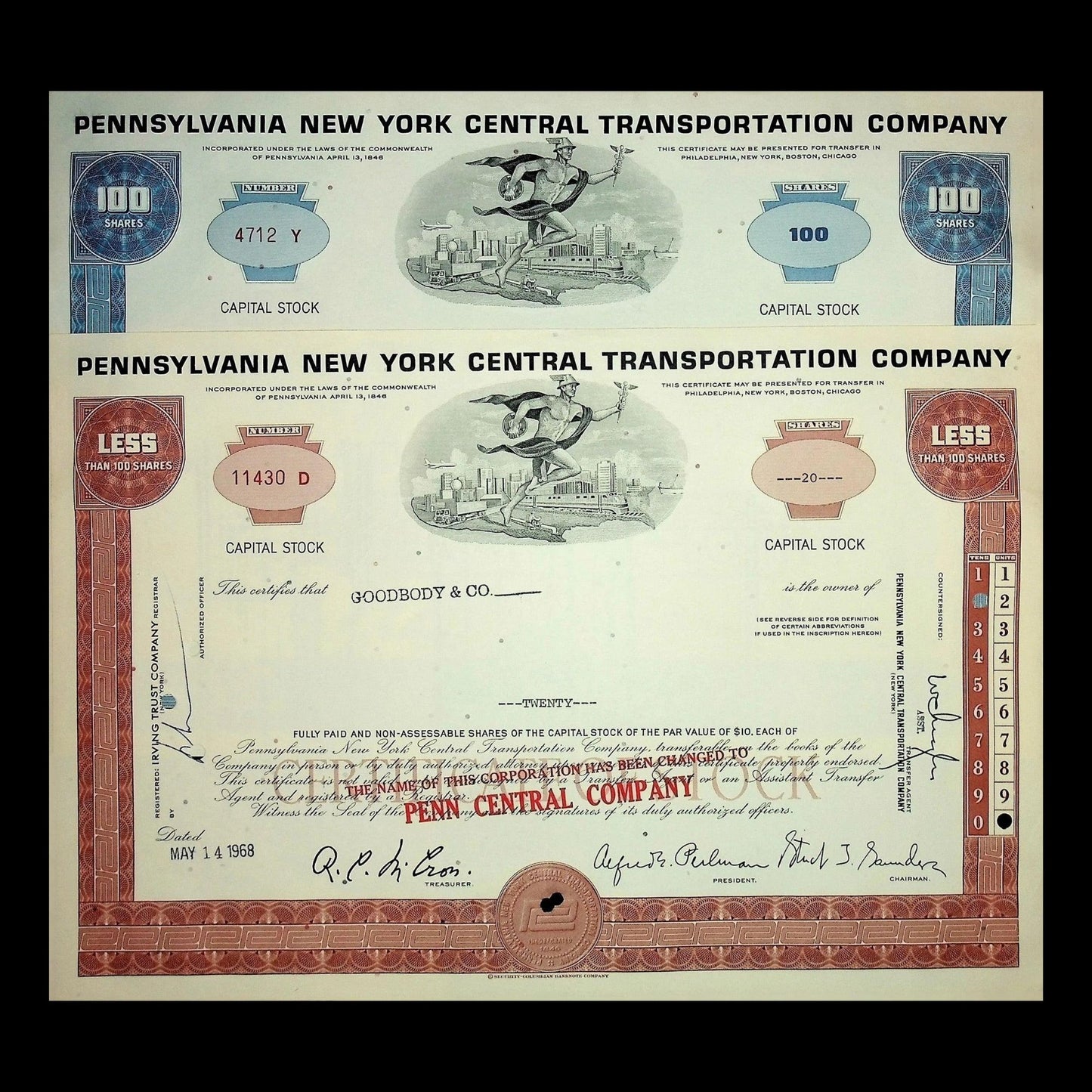

This green bond certificate from MGIC Investment Corporation, issued in 1979 for $1,000, features a vignette of a woman in front of a cityscape. The bond, due in 1988, paid 8 3/8% interest and includes cancellation holes, stamps, and handwritten annotations, indicating its authenticity and prior use.

MGIC Investment Corporation, the parent company of Mortgage Guaranty Insurance Corporation (MGIC), was founded in 1957 by Max Karl, a real estate attorney in Milwaukee, Wisconsin. At the time, the national population was growing rapidly due to the Baby Boom, and there was a strong demand for homeownership. However, the high cost of homes and the requirement for a 20% down payment posed significant challenges for many prospective homeowners.

Max Karl recognized these challenges and saw an opportunity to simplify the mortgage insurance process. Instead of the cumbersome process of securing 100% government-backed loans, Karl proposed a private company that would insure only the top portion of a mortgage. This approach aimed to make low-down-payment financing more accessible and less bureaucratic. With $250,000 in capital from investors, including Savings & Loan executives, his family, and friends, Karl established MGIC.

MGIC quickly became the nation's leading provider of private mortgage insurance, helping more than 5,000 lenders across the U.S. and Puerto Rico. By providing mortgage insurance, MGIC played an important role in the residential mortgage finance system, protecting mortgage investors from credit losses and enabling consumers to achieve homeownership with low-down-payment loans.

Materials and care

Materials and care

Here are some quick tips to preserve your certificate for decades to come.

Paper quality: Stock certificates were printed on a variety of certificate paper dating back to the mid 1800s. Most of these vintage collectable certificates have signs of used & wear , cancellation holes, pencil / pen writing, stamps, staples, adhesives, slight rips, missing coupons and other features.

Handling: Always handle the certificate with clean, dry hands or use cotton gloves to avoid transferring oils and dirt from your skin onto the paper.

Storage: Store the certificate in a cool, dry place away from direct sunlight, which can cause fading. Use acid-free folders or archival-quality plastic sleeves to protect it from moisture, dust, and physical damage.

Framing: If displaying the certificate, use a frame with UV-protective glass to prevent light damage. Ensure the certificate is mounted using acid-free materials to avoid any chemical reactions that could degrade the paper over time.

Avoid Exposure: Keep the certificate away from direct sun, extreme temperatures and humidity, which can cause the paper to warp or deteriorate. Avoid exposing it to pollutants, such as smoke or chemicals, which can cause discoloration.

Secure payment with all major providers

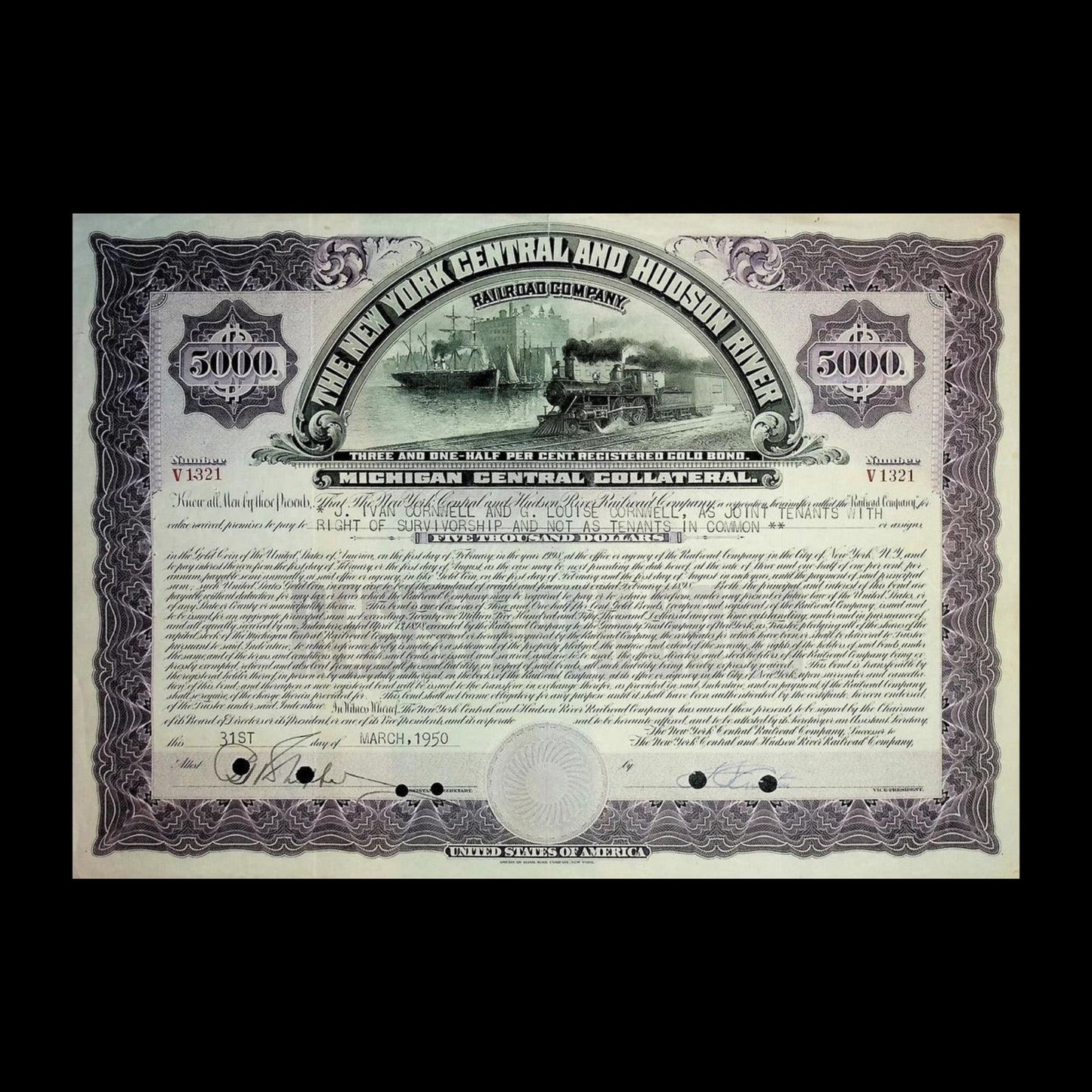

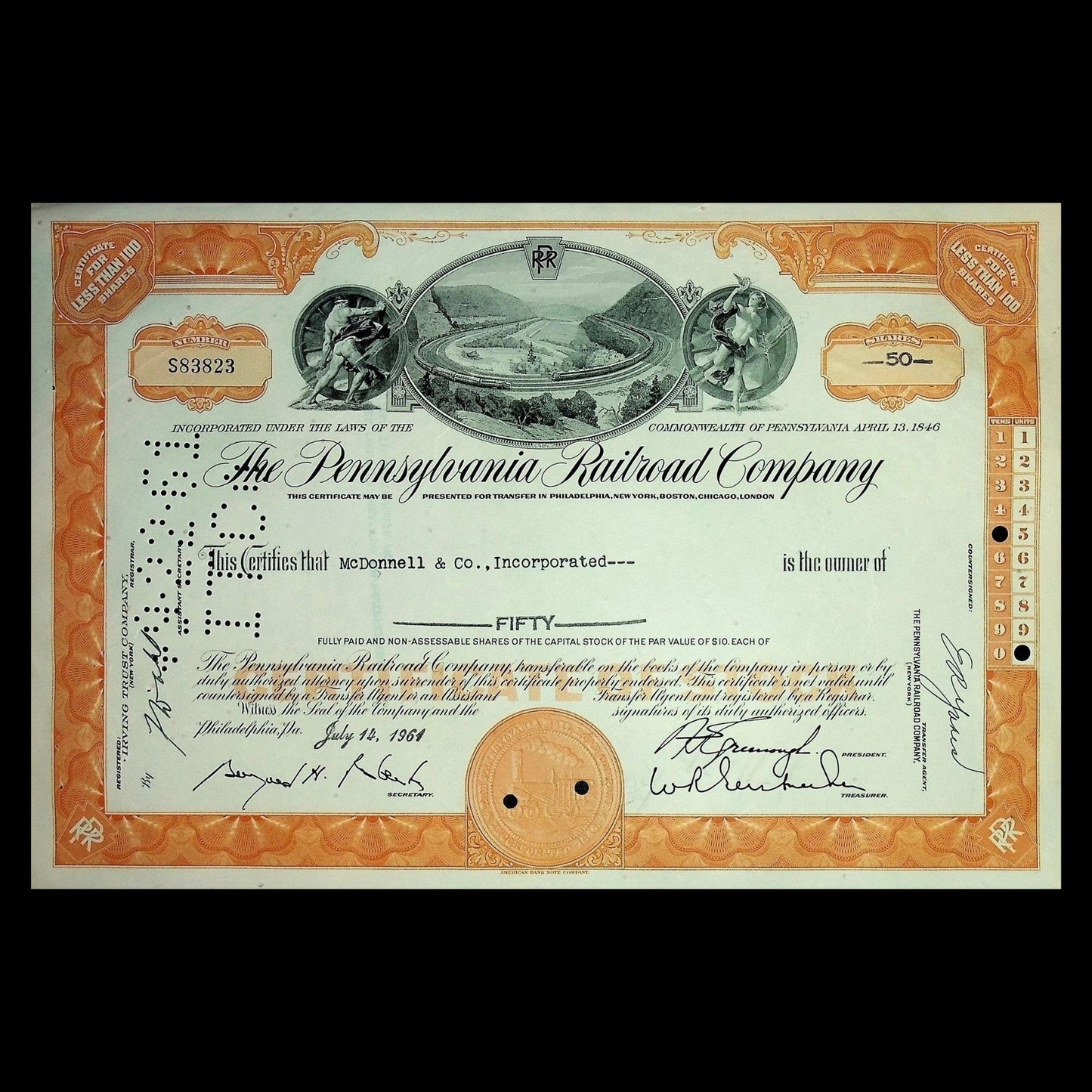

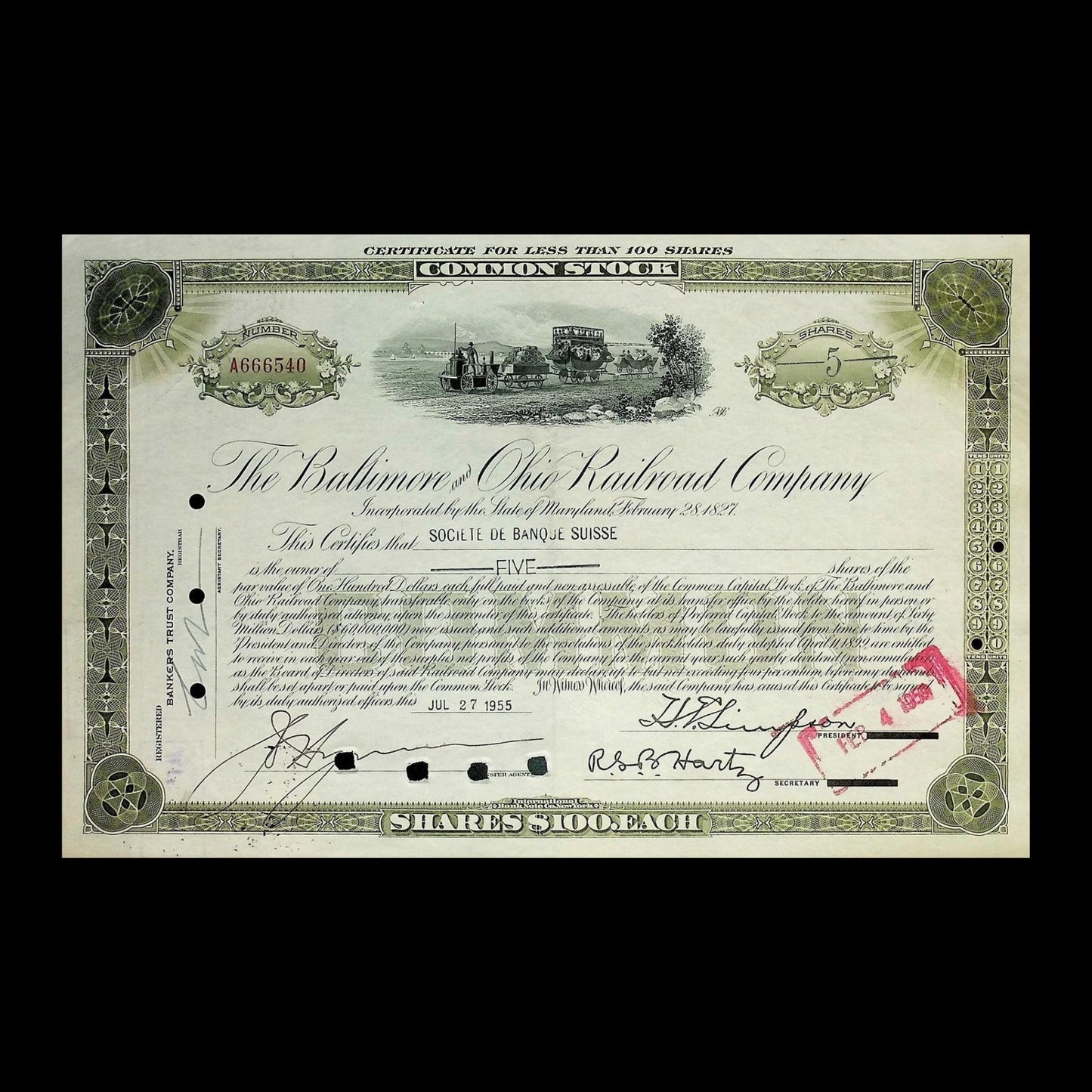

Iconic American Railroads Stock & Bond Certificate Five Pack - 4x Stocks & 1x Bond Bundle

4x Stock Certificate Replica Postcard Pack of Iconic American Companies

Discover 1,000s of Wall Street Collectables

Explore Our Collections

-

American Classics

Showcasing the evolution of American industry through beautifully engraved certificates from iconic...

-

Banks, Insurance & Investment

Discover the rich history of American finance with our collection of authentic...

-

Food & Drink

Collectible Food & Drink Stock & Bond Certificates for Sale - Hershey's, Nabisco,...

-

Transportation

Discover our collection of collectable stock and bond certificates for sale from...

-

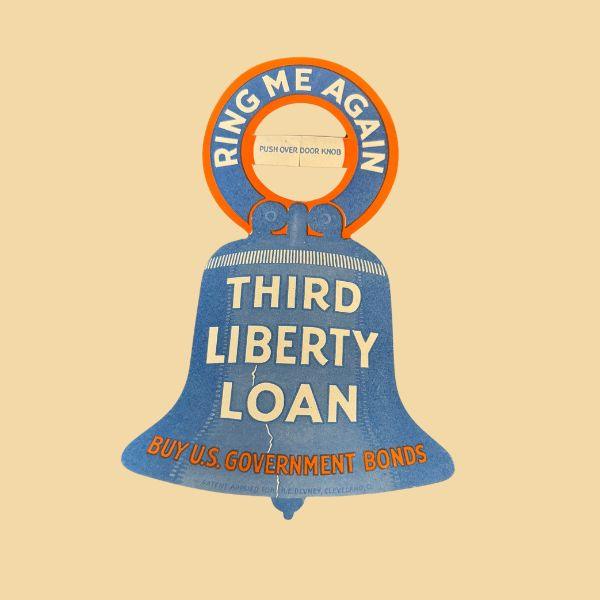

World Wars

Discover our unique collection of World War-era bonds and Disney wartime memorabilia,...