Fund of Letters Inc (Charlie Munger owned) Stock Certificate from 1960s

Fund of Letters Inc (Charlie Munger owned) Stock Certificate from 1960s

Couldn't load pickup availability

Are the certificates authentic?

Are the certificates authentic?

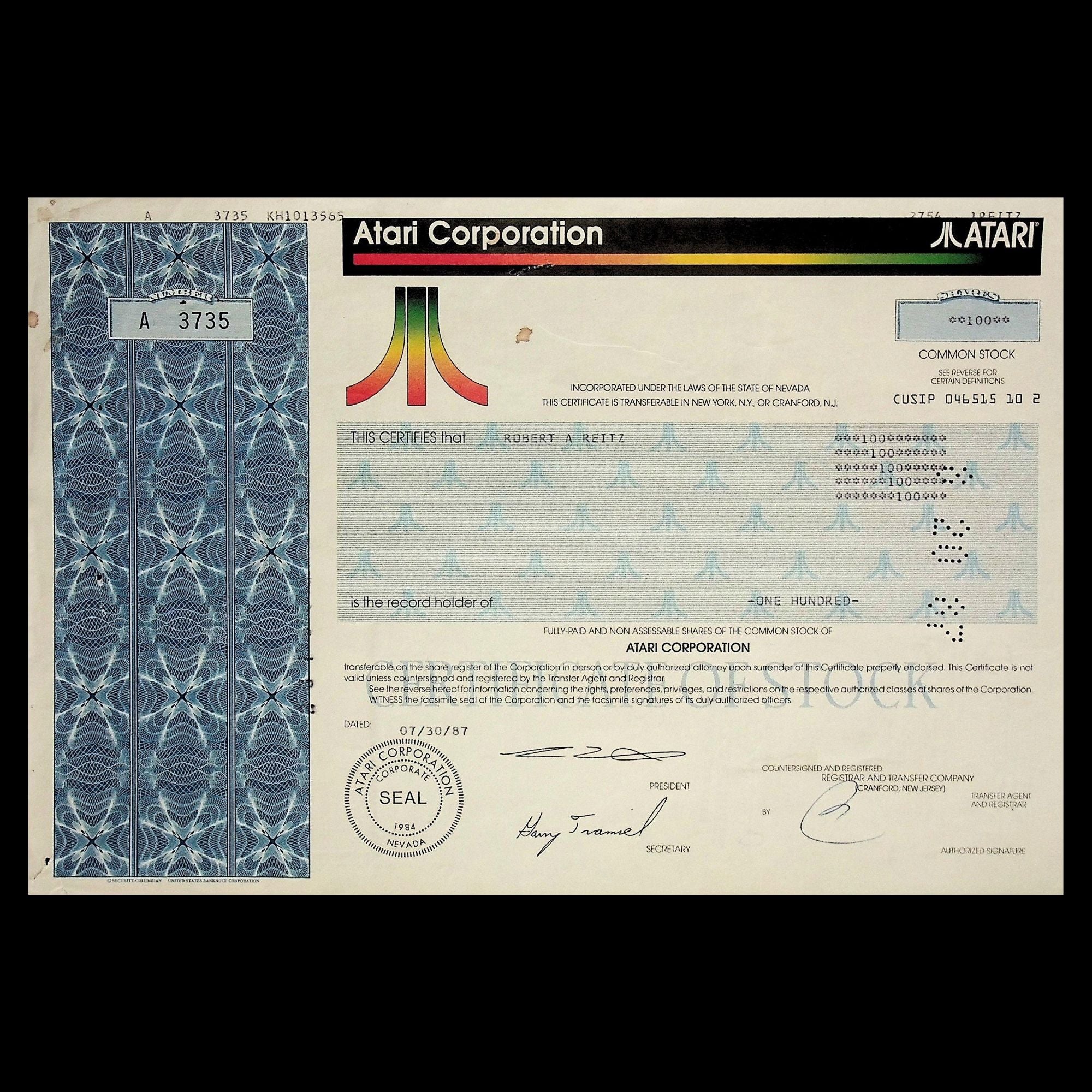

Yes, all of the certificates we sell are authentic stock and bond certificates unless otherwise mentioned in the description. At one point in time, this certificate represented a share of of the company, or a bond receipt. These certificates have been removed from circulation and digitalized, as seen by cancellation holes, stamps and writing on the certificate. We offer these certificates as a collectable item, not a security.

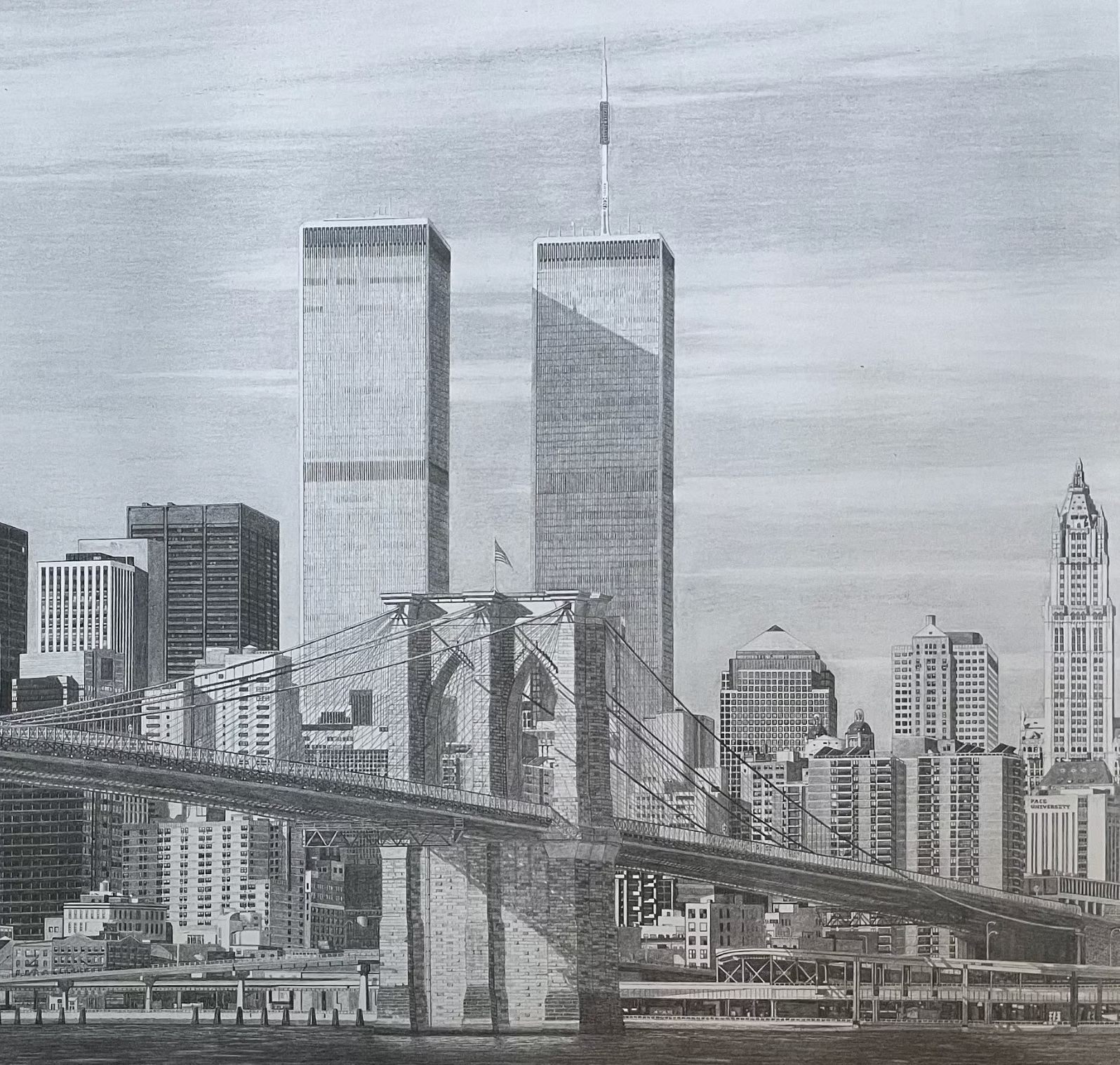

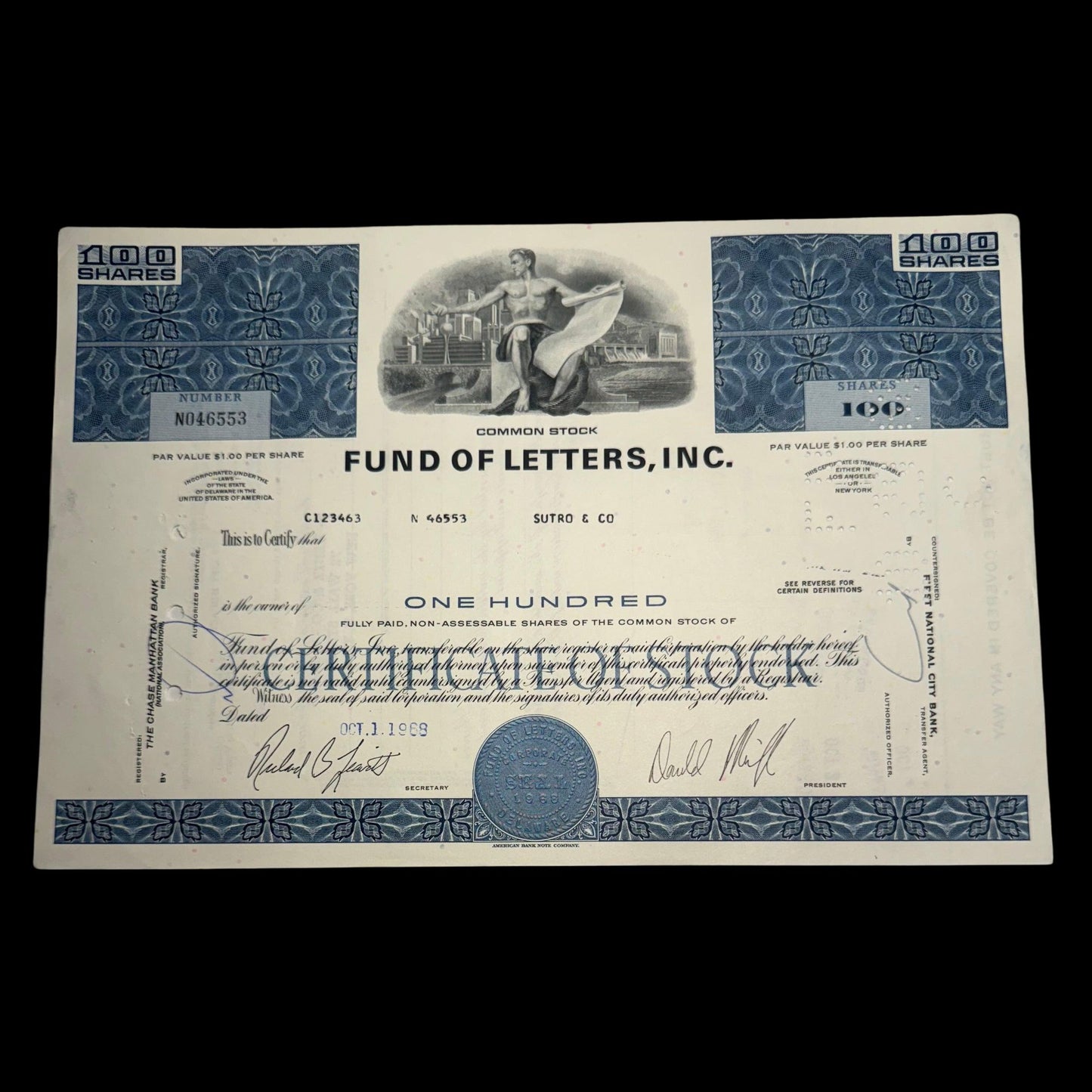

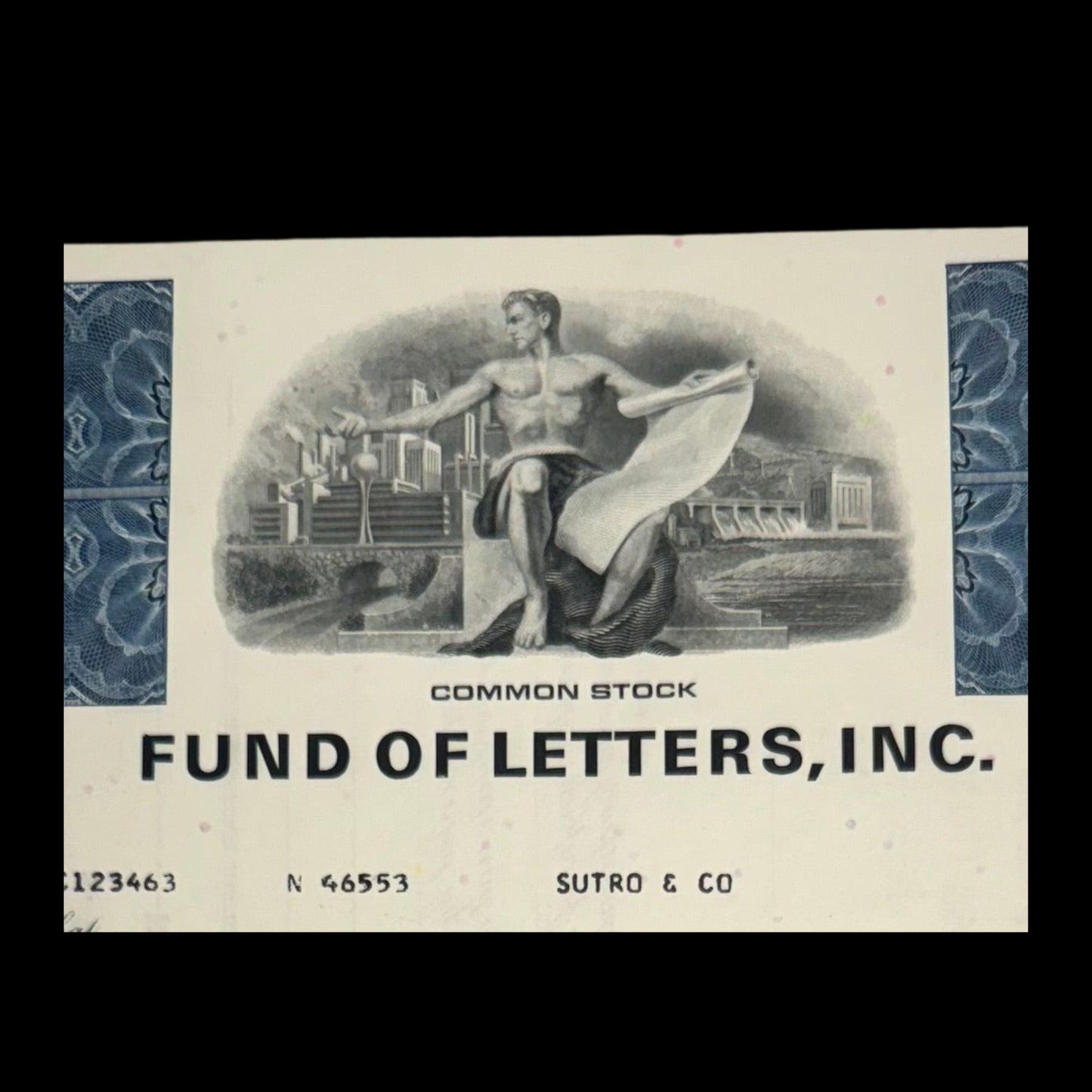

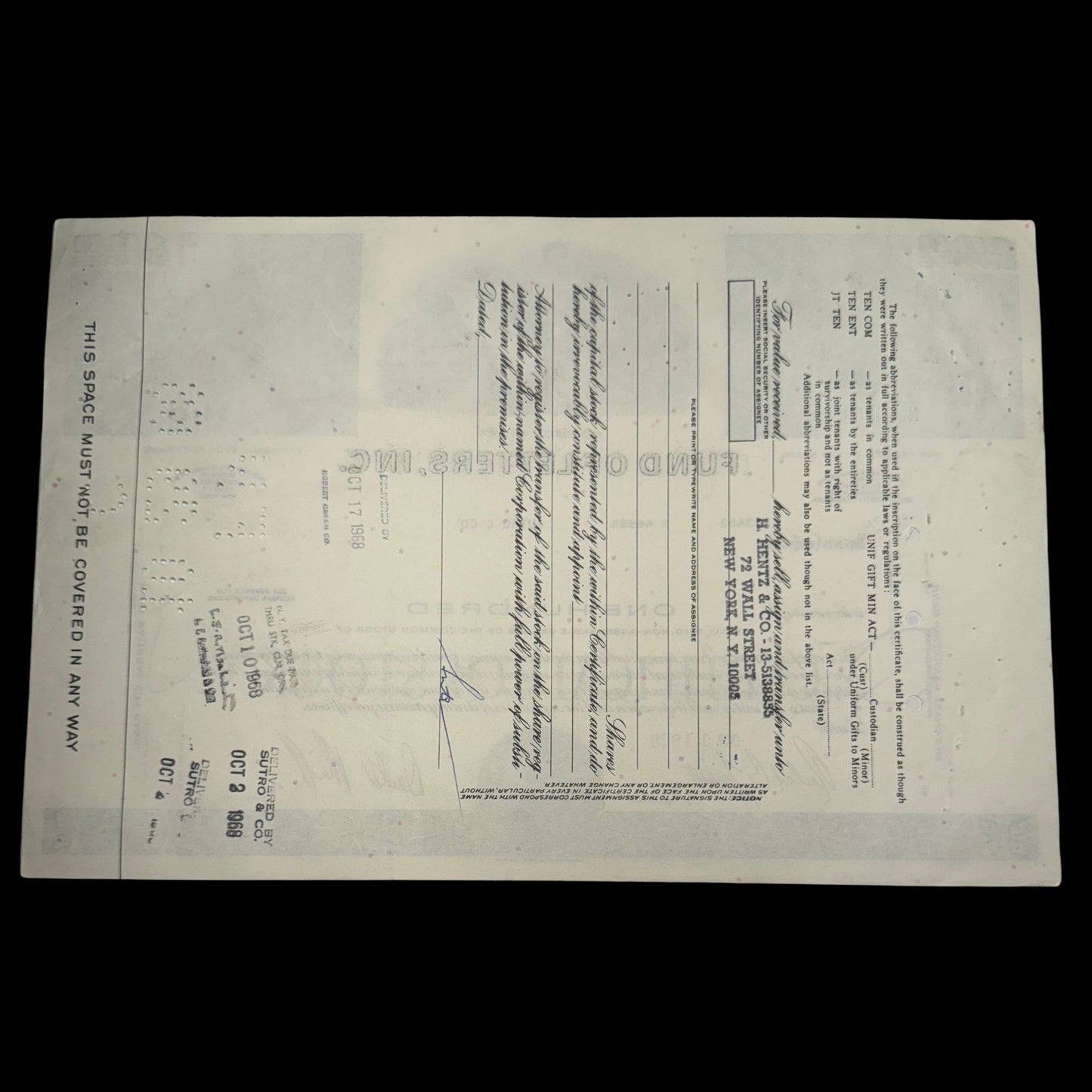

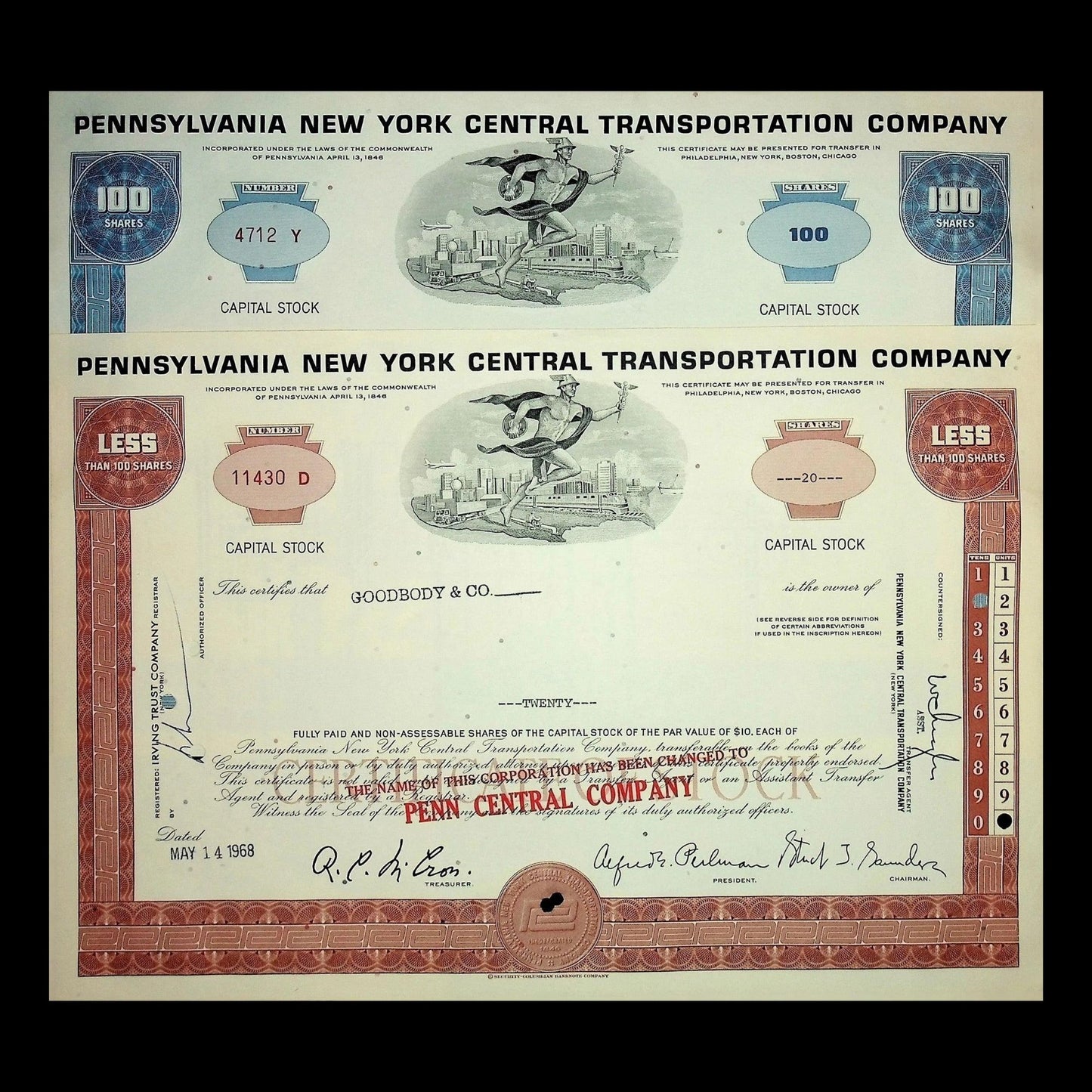

This blue stock certificate from the Fund of Letters, issued in 1968, features a vignette of a male figure with city buildings and a power plant in the background.

The certificate includes cancellation holes and stamps, indicating its authenticity and historical usage. It was printed by the American Banknote Company. You will receive a certificate similar to the one showed in the photos.

The Fund of Letters was a registered closed-end investment company that emerged during the "go-go years" of the 1960s, when "letter stocks"—securities sold without SEC registration—became popular in Beverly Hills, California. These stocks had restrictions that prevented them from being sold in ordinary stock market transactions for an extended period. The Fund of Letters, essentially a venture capital fund, was launched with a highly publicized initial public offering, raising $60 million, though only $54 million remained for investment after fees.

As a closed-end investment vehicle, the fund could not raise additional capital from the market. Its only option to increase net asset value was through sensible investments, a task complicated by its initial high expenses. Consequently, the fund soon traded below its net asset value. Investors Munger and Guerin seized this opportunity to acquire the business and implemented significant changes.

According to Janet Lowe's book "Damn Right! Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger," the fund was renamed the New America Fund, the board was reorganized, and the investment style shifted to a value approach. They quickly liquidated assets chosen by former managers, aligning the fund's philosophy with Munger's value investment strategy.

In 1979, Business Week highlighted the New America Fund's success, noting that officer and director remuneration was only $54,950, while net asset value per share increased from $9.28 in October 1974 to $29.28 on September 30, 1979. The fund's holdings included Capital Cities Communications, 100% of the Daily Journal Corporation, and Blue Chip Stamps, which accounted for about 25% of its assets.

Materials and care

Materials and care

Here are some quick tips to preserve your certificate for decades to come.

Paper quality: Stock certificates were printed on a variety of certificate paper dating back to the mid 1800s. Most of these vintage collectable certificates have signs of used & wear , cancellation holes, pencil / pen writing, stamps, staples, adhesives, slight rips, missing coupons and other features.

Handling: Always handle the certificate with clean, dry hands or use cotton gloves to avoid transferring oils and dirt from your skin onto the paper.

Storage: Store the certificate in a cool, dry place away from direct sunlight, which can cause fading. Use acid-free folders or archival-quality plastic sleeves to protect it from moisture, dust, and physical damage.

Framing: If displaying the certificate, use a frame with UV-protective glass to prevent light damage. Ensure the certificate is mounted using acid-free materials to avoid any chemical reactions that could degrade the paper over time.

Avoid Exposure: Keep the certificate away from direct sun, extreme temperatures and humidity, which can cause the paper to warp or deteriorate. Avoid exposing it to pollutants, such as smoke or chemicals, which can cause discoloration.

On orders over $50

Or your money back

Trust us to build their collection

Secure payment with all major providers

Trusted By Thousands of Collectors

Let customers speak for us

Art with a Backstory

Every Certificate Tells A Story

Turn rare stock and bond certificates into timeless décor. Piece showcases bold colors, engravings, and historic signatures perfect for an office, library, bar, common area, museum & more.

Orders Ship Daily

Direct From Wall Street's Archives

Orders are shipped flat with care, tracked & insured with USPS, in a strong, rigid, protected envelope. Daily fulfillment Monday - Thursday from NYC.

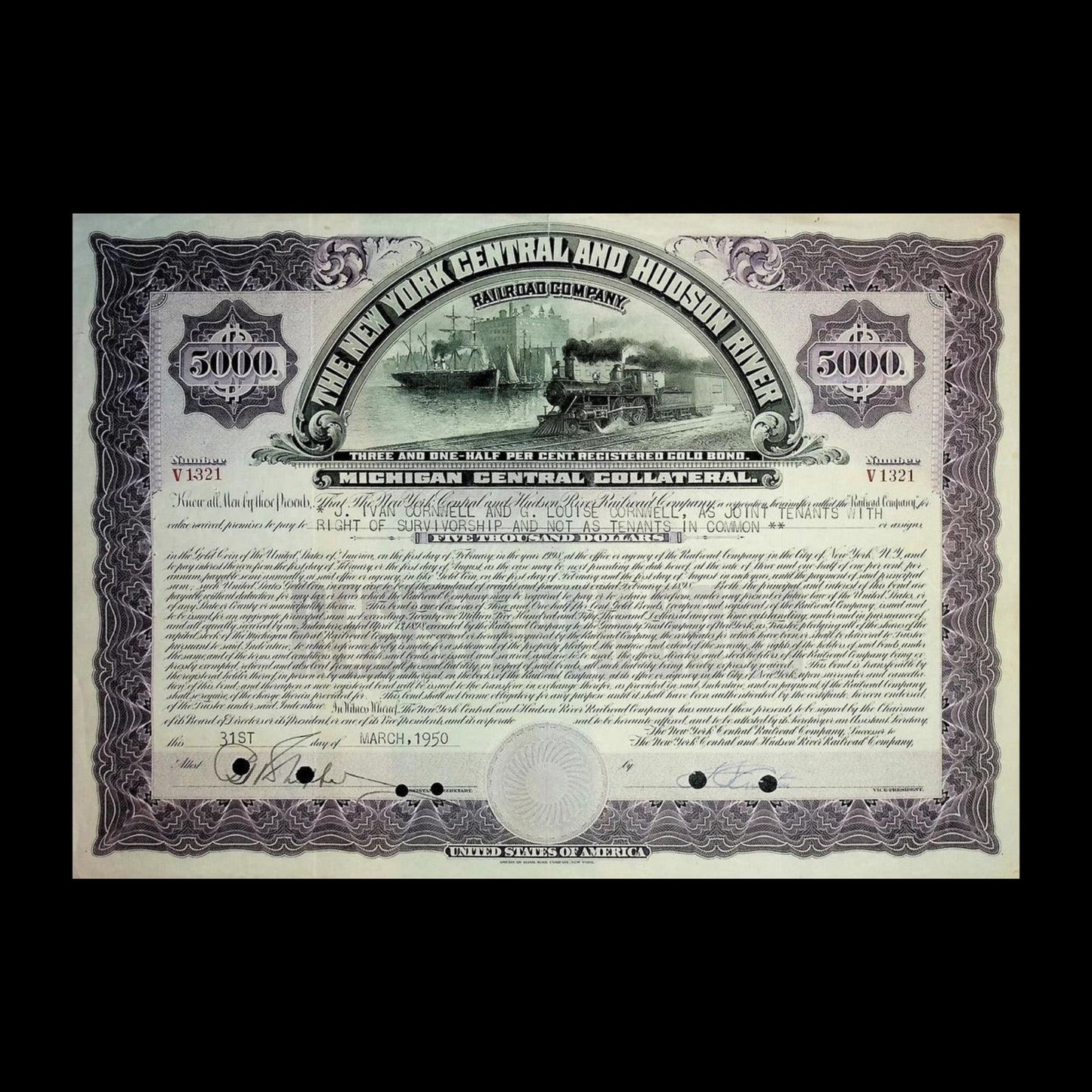

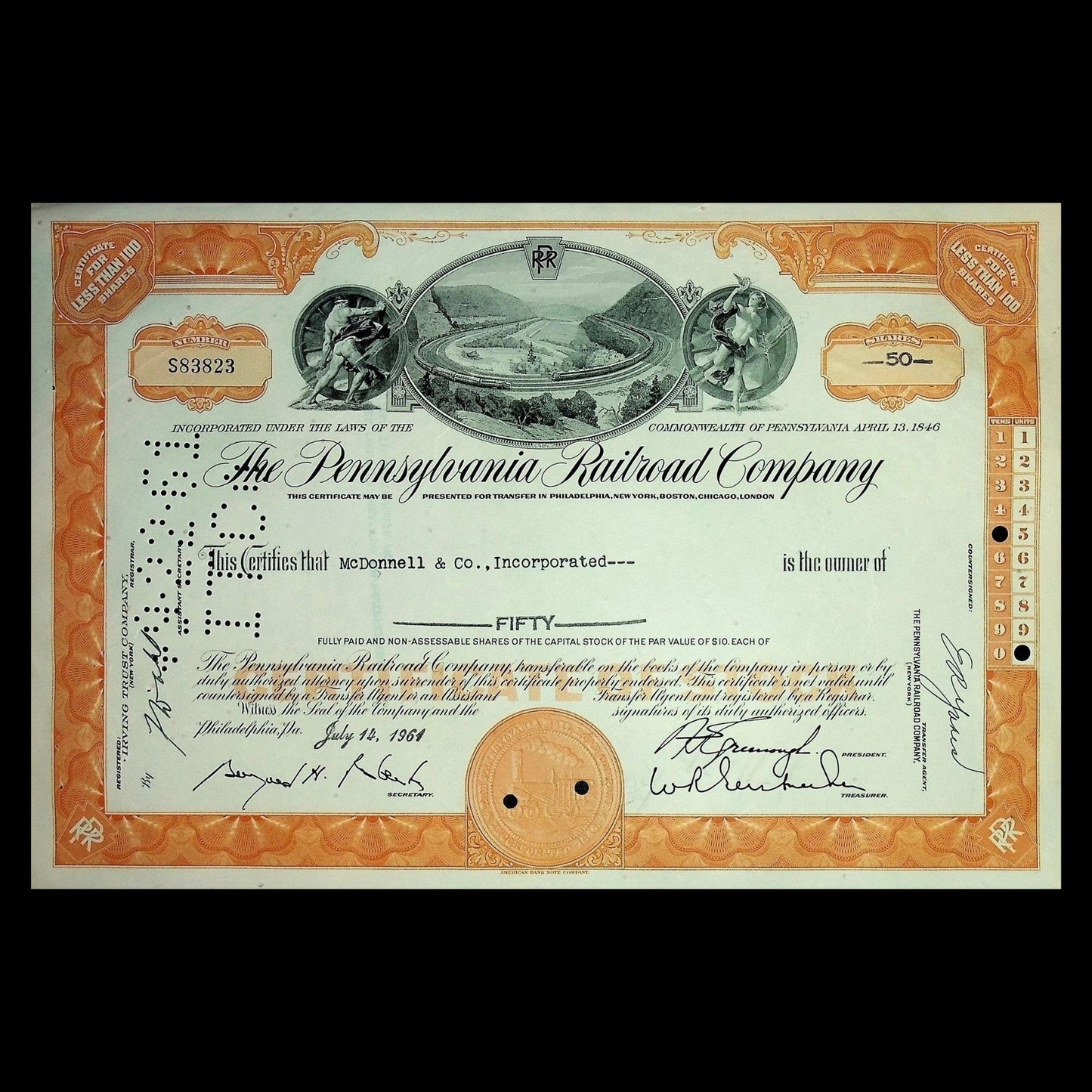

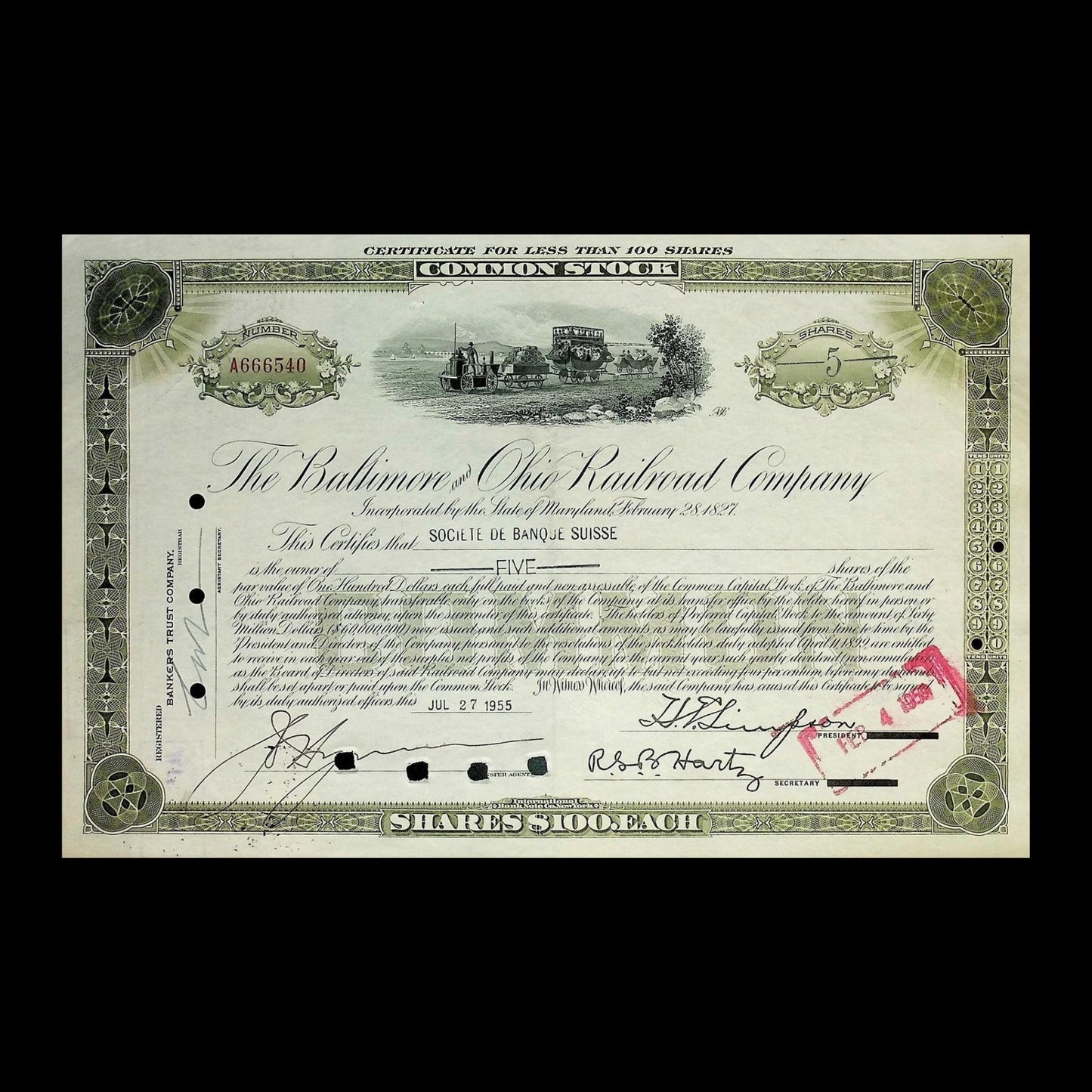

Railroad Stock & Bond Certificate Collectable Bundle Five Pack - 4x Stocks & 1x Bond

Discover 1,000s of Wall Street Collectables

Explore Our Collections

-

American Classics

Showcasing the evolution of American industry through beautifully engraved certificates from iconic...

-

Banks, Insurance & Investment

Discover the rich history of American finance with our collection of authentic...

-

Food & Drink

Collectible Food & Drink Stock & Bond Certificates for Sale - Hershey's, Nabisco,...

-

Transportation

Discover our collection of collectable stock and bond certificates for sale from...

-

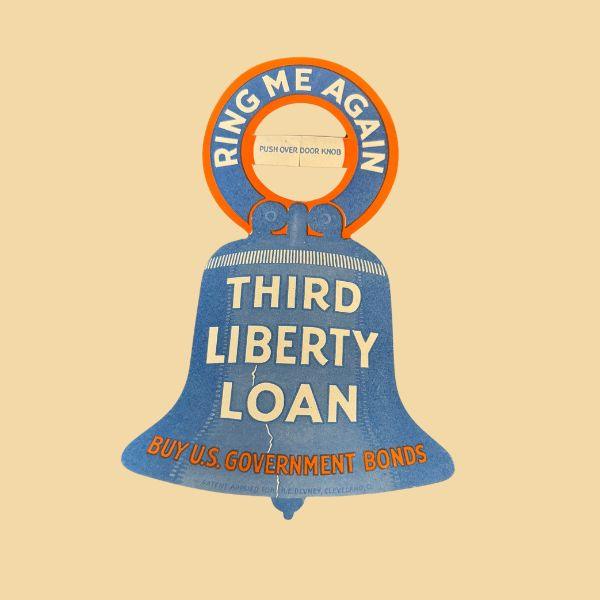

World Wars

Discover our unique collection of World War-era bonds and Disney wartime memorabilia,...